What is a Foreign Trade Zone Site (FTZ)?

Foreign Trade Zones are secured, designated locations near a U.S. Customs Port of Entry. They’re considered to be outside of U.S. Customs territory. As a result, businesses can reduce or eliminate duty on imports. Created by Congress in the Foreign Trade Zones Act of 1934, they continue to help American companies compete in the global economy. When foreign parts and products enter the country, they do not clear Customs at the Port of Entry. Instead, cargo receives preferential treatment with duties deferred, reduced or eliminated. In addition, there are supply chain, inventory control and other savings realized.

What are the benefits of using an FTZ?

Cash Flow

For companies in an activated zone or subzone, increased cash flow and reduced expenditure are often the biggest benefits. They can defer, reduce or even eliminate duties and fees paid on imported products.

- There is significant deferral on the average inventory during the first year in program

- Foreign merchandise in the zone may be re-exported free of duty and federal excise tax

- No duties are paid on returns of foreign merchandise to exporters

- Value added to merchandise within the zone is not dutiable

- Certain duty deferral and reduction benefits apply on production equipment

- The insurable value of foreign merchandise in a zone or subzone will not include customs duties already paid, reducing insurance premiums.

Supply-Chain Timeline

Product bypasses Customs at the port of entry, often resulting in a one to three day reduction in time spent awaiting processing and inspection. With prior approval by Customs, zone operators can facilitate the movement of foreign product: Customs officers do not need to be present to break seals or ship products. This benefit is especially valuable to 3PLs and large distribution centers with cross-dock operations.

Inventory Control

Operating a a Foreign Trade Zone demands accurate reporting of foreign merchandise from receipt and processing to shipment for export or entry into U.S. customs territory. It also provides inventory management benefits:

- Reduces inaccurate inventory, emergency shipments and tracking of import receipts from the point of origin to the final destination.

- Increased accountability reduces staff time needed to deal with government regulations

- Fungible inventory accounting methods, such as FIFO and FOFI (foreign first), are approved for zone operations

If you’d like to learn more about how your company could benefit from Foreign Trade Zone 176, read our blog or consider a feasibility study.

Who can operate a Foreign Trade Zone?

Any entity can become an activated site or subzone. Most are owned and operated by private businesses through approval and regulation from the federal government.

Who approves and regulates Foreign Trade Zones?

There are several government agencies involved in approving and regulating Foreign Trade Zones. Agencies involved include:

- The U.S. Department of Commerce International Trade Administration, Foreign Trade Zones Board (National FTZ Board) – this agency of the federal government administers Foreign Trade Zones in the United States as set-forth in the U.S. Foreign Trade Zones Act (1934). Specific roles they play include:

- Approval of port districts (“grantees”) to establish Foreign Trade Zone Service Areas; they approved the creation of FTZ #176

o Approval of the creation of foreign trade zone usage-drive sites and subzones as applications are submitted by the grantees

- Approval of port districts (“grantees”) to establish Foreign Trade Zone Service Areas; they approved the creation of FTZ #176

- U.S. Customs & Border Protection – Once approved by the National FTZ Board, sites and subzones can become an activated site or subzone by following procedures set-forth by U.S. Customs & Border Protection. The regional CBP office overseeing each site or subzone must approve of the security and customs entry processes and procedures established by the operator of the site or subzone.

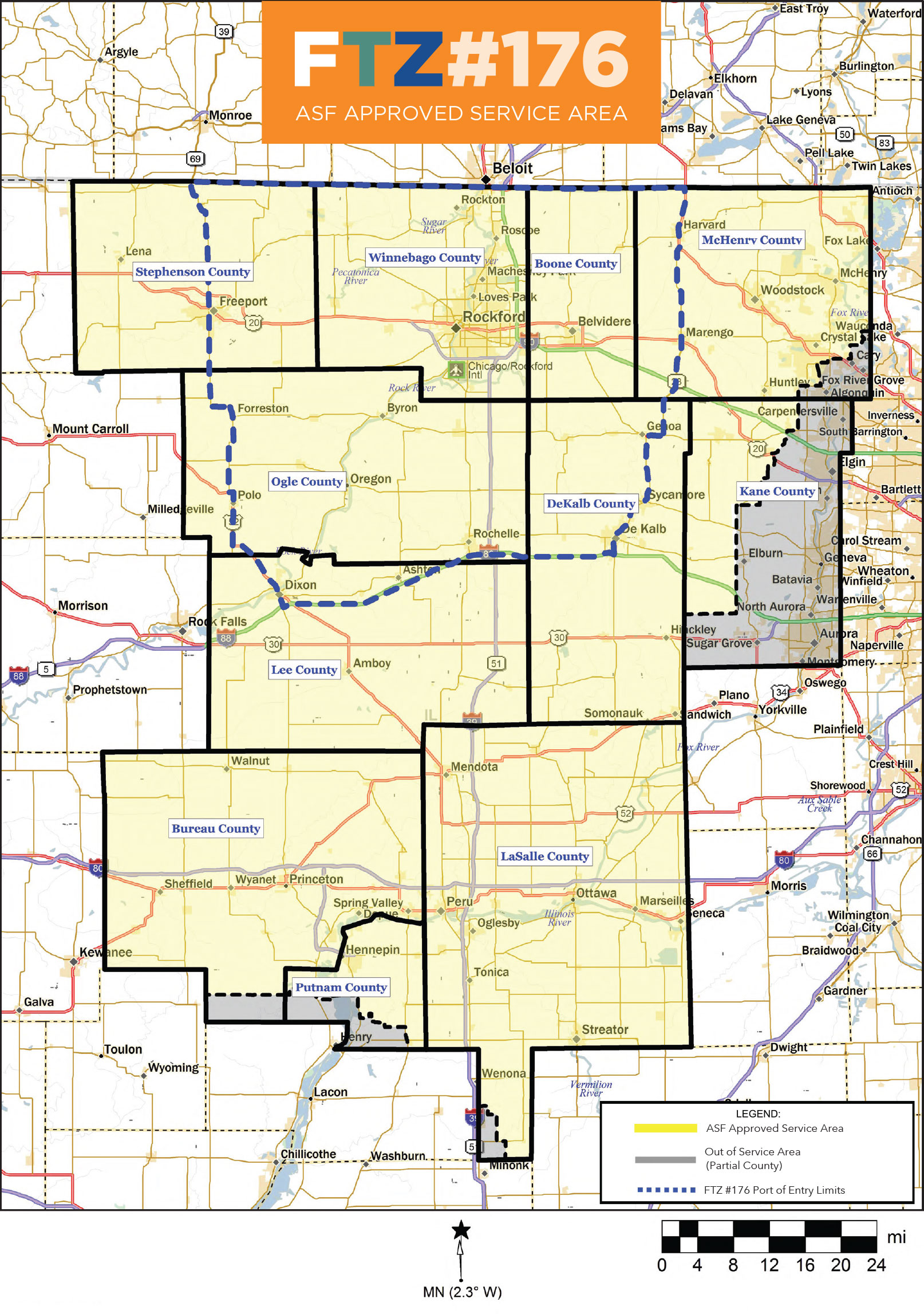

- The Greater Rockford Airport Authority (GRAA) – In 1991, the National FTZ Board approved the GRAA’s application to become a grantee of the program, serving the Rockford Region; in 2007 the GRAA reorganized under the Alternative Site Framework (ASF), allowing FTZ #176 to serve a defined 11 county service area in Northern Illinois. This means that companies in the defined 11 counties can make application through FTZ #176 to become an activated site or subzone.